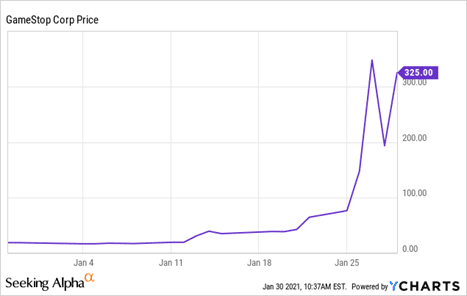

Shepherdstown, W.Va., – After a steady decline towards bankruptcy, GameStop’s stock value saw a sharp increase in value with prices rocketing from $20 to over $300 per unit. This follows a decline of more than 180% in late January due to short sellers betting on the stock’s decline.

If you’ve been following the news lately, you may know more about finances and the stock market than you did before. That’s because some users over on Reddit caught some wealthy hedge fund investors with their hands deep into the cookie jar.

Stocks follow the basic rules of supply and demand – when you buy stocks, the price goes up. When you sell stocks, the price goes down. The goal is to buy low and sell high to make a profit. You could do this to make a few quick dollars without putting much on the line, since in buying stocks, all you risk losing is your base investment if the stock value tanks. Short selling, however, is a much riskier way to trade stocks that can also potentially reap more rewards.

Investors do this by borrowing stocks from their buddy and selling it immediately. Doing this with large enough quantities of stock should cause the value to drop sharply.

So, in money terms, if they borrow the stock and sell it at $100, and the stock drops to $1, they make a profit of $99. Since shareholders refer to stocks as their measurement on a company’s success, this damage to stock can lead to a loss of finances and jobs for those down the ladder of the company.

This is exactly what hedge funds were doing to GameStop – a company that was already on a decline, so who would notice? Users frequenting r/wallstreetbets did and began investing their own money into GameStop’s stocks, driving up the price on the hedge funds upwards of 180% in value.

Investors must return their shares eventually, so what Reddit is doing is forcing these multi-millionaire hedge funds to purchase millions of dollars’ worth of stocks to return on their initial investment, leaving them deep in the hole. And with large-scale investors like Elon Musk throwing their own money into the pool, the only way things can go is up.

![]()

This led to a lot of outcry from the media and those who stand to lose the most. Trading services like Robinhood had temporarily disabled the ability to purchase certain stocks, limiting users to selling their stocks as their only option. Some of these agencies also began to sell off user’s stocks automatically, as is stated is their right to do deep down in their terms of services. Discussion sparked about whether Wall Street really exists as

Sharply increasing a stock’s value this way is, by the rules of the market, entirely legal – but legal does not always mean safe. In artificially inflating a stock’s value, the company loses the credibility of their stocks – an important resource for investors and media coverage to

![]() judge the state of the company. The effects of this reach beyond wall street as investors withdraw and finances tank.

judge the state of the company. The effects of this reach beyond wall street as investors withdraw and finances tank.

There has been talk of limitations put onto who can invest and how much you can invest. Now that the secret is out and the idea to invest in mass into a stock is a public idea and not just held private to millionaire investors, what will Wall Street do to prevent the public from tanking stocks for profit?

Many investors were making out with more money than they thought they would ever have. Everyday people suddenly have the funds to pay off student loans and medical bills. House payments are being made and small businesses are given new life. But did it really have to take an overthrow of the stock market for us to be able to make the money to get by?

Does all that make this poetic justice, or will the ramifications be worse than we could anticipate? We’ve really got no choice but to wait and find out.

Leave a Reply